After its launch in 2016, UPI i.e. unified payment interface has grown quite significantly. This technology is already adopted by some of the big players and millions of UPI transactions take place every day.

The latest development is UPI ATM i.e. ATMs with UPI technology integrated within them. This simply means that you can leverage the power of UPI on such ATMs. RBI has recently confirmed that soon customers will be able to deposit money using UPI too. This shows that the Unified Payment Interface will be a key part of ATMs and CDMs.

Normally to deposit or withdraw cash, customers need to use their debit cards for authorization. In the event of a damaged or lost debit card, customers can’t utilize the cash deposit or withdrawal facilities at ATMs. UPI enabled ATMs don’t required you to authenticate using debit card. The authorization is done using UPI on UPI app.

List of Banks Providing UPI ATM Services

Following banks are providing UPI ATM services to general public. More details HERE

| State Bank of India | Bank of Baroda | City Union Bank |

| Union Bank of India | Indian Bank | Yes Bank |

| Canara Bank | Central Bank of India | Bank of India |

| Utkarsh Small Finance Bank | Punjab National Bank | Punjab and Sind Bank |

| UCO Bank | Indusind Bank | HSBC |

| Karur Vyasa Bank | Federal Bank | Ujjivan Small Finance Bank |

| Equitas Small Finance Bank | Suryoday Small Finance Bank | Fincare Small Finance Bank |

| Cosmos Bank | GP Parsik Sahakari Bank Ltd | Janata Sahakari Bank |

| The Mehsana Urban Co-op Bank | Andhra Pragathi Grameena Bank | Andhra Pradesh Gramin Vikas Bank |

| Chhattisgarh Gramin Bank | Deccan Gramin Bank | Uttarakhand Gramin Bank |

| Saurashtra Gramin Bank | Rajasthan Marudhara Gramin Bank | Karnataka Vikash Gramin Bank |

| Meghalaya Rural Bank | Arunachal Pradesh Rural Bank | Hitachi |

Find a UPI ATM Bank Near You

How to Withdraw Cash from UPI ATM?

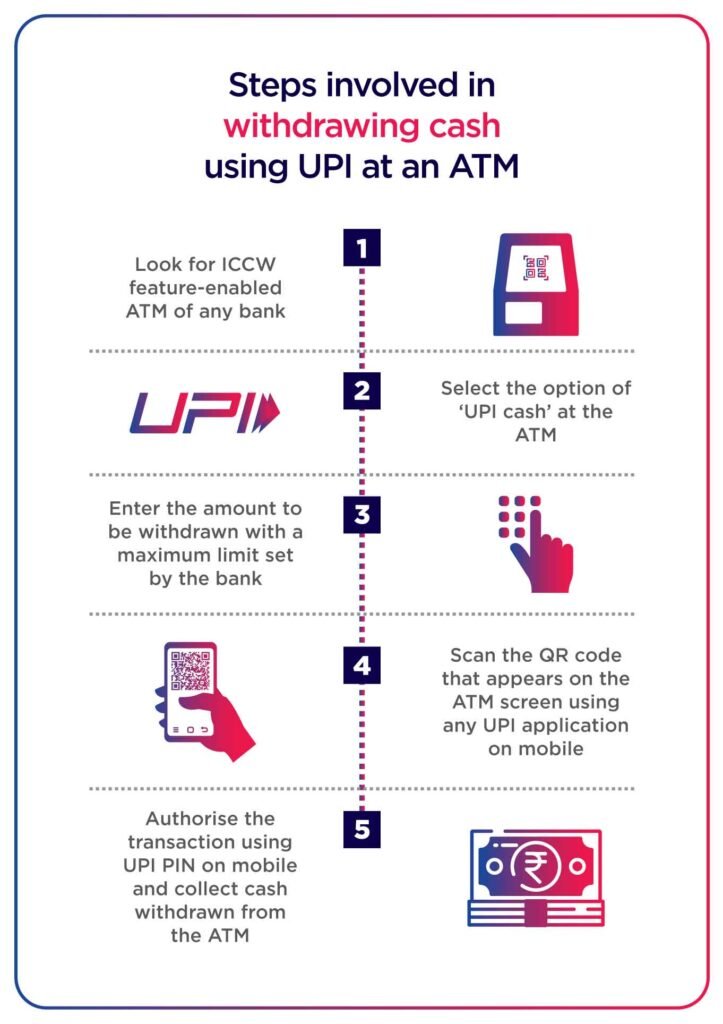

Locate a UPI-Enabled ATM: First, find an ATM that supports UPI-based cardless cash withdrawal i.e. have the ICCW feature. These ATMs will typically have a UPI logo or mention of UPI services.

Select UPI Withdrawal Option: On the ATM screen, look for and select the option for a UPI cash withdrawal.

Enter Withdrawal Amount: Now, you need to enter the amount of cash you wish to withdraw.

Scan the QR Code: After you do this, the ATM will generate a dynamic, one-time use QR code on its screen. Use your smartphone to scan this QR code using a UPI-enabled app (like BHIM, Paytm, Google Pay, or any bank’s UPI app that supports this feature).

Authorize the Transaction: After scanning the QR code, your UPI app will prompt you to enter your UPI PIN. Enter your PIN to authorize the cash withdrawal.

Collect Your Cash: Once the transaction is authorized, the ATM will dispense the cash.

For More information on UPI Cash Deposit & Withdrawal, READ THIS

Nearby UPI ATM FAQs

What is ICCW Feature Enabled ATM?

Interoperable Cardless Cash Withdrawal (ICCW) service enabled via the UPI-ATM system. This service allows customers from participating banks who use UPI to withdraw cash from any enabled ATM without needing a physical card.

Is debit card required at UPI ATMs?

No, there is no need to carry your debit card at UPI enabled or ICCW service enabled ATMs. Make sure you carry your mobile.

What is the Withdrawal limit at UPI ATM?

The withdrwal limit is ₹10,000 per transaction, within the existing UPI daily limit and any specific limits set by the issuing bank for UPI-ATM transactions.

Quick Links

| NPCI on UPI ATMs | Read Here |