UPI was officially introduced in India on 11th April 2016. A lot has changed since then. Many big players have adopted this technology. Today millions of transactions are done per day through BHIM, Google Pay, Phonepe, Mobikiwik and Paytm.

Previously, to use UPI, you needed to connect your bank account to the app. This allowed you to make instant payments using UPI technology. However, with the launch of Pocket UPI, transactions directly from bank accounts are not mandatory.

What is Pocket UPI?

MobiKwik has added a new feature called ‘Pocket UPI’ to its platform, which lets users make UPI payments through the MobiKwik Wallet without linking their bank account. This feature helps users manage their budget and finances better, while also protecting them from fraudulent transactions by using funds from their MobiKwik Wallet instead of their bank account.

Overview

| Product/Service | Pocket UPI |

| Launched by | Mobikwik |

| Launch Month | February 2024 |

| Key Feature | Wallet Based UPI Service |

How is Pocket UPI Different from Regular UPI?

The most basic difference is the source of the payments. With UPI, money is deducted from one’s linked bank account and transferred to the recipient’s bank account.

In case of Pocket UPI, one can utilize the power of UPI without linking bank accounts. The money will be taken from the Mobikwik Wallet, a digital wallet where you can add money and use it later.

| Regular UPI | Pocket UPI |

| User needs to link bank accounts for UPI facility | No need to link bank accounts for UPI facility |

| Money is debited from a bank account. | Money is debited from user’s Wallet on Mobikwik app. |

Benefits of Mobikwik’s Pocket UPI

Pocket UPI by MobiKwik makes sending and receiving money really simple and quick. Here’s how it helps users :

- First of all, it is incredibly fast. You set up a unique UPI handle linked to your MobiKwik wallet instead of a bank account. This means you don’t have to enter your bank details to make use of UPI.

- Not Dependent on Bank Servers : If there’s any problem with the bank’s servers, your transactions won’t be affected because the money comes from your wallet, not directly from your bank.

- Another big plus is that it helps you manage your budget better. You can put a fixed amount in your MobiKwik wallet and only spend that much. This way, you won’t overspend, and it’s easier to keep track of how much you are using.

- Pocket UPI works everywhere UPI payments are accepted, which is almost everywhere these days. You can use it easily for paying for a movie ticket, shopping online, or splitting a restaurant bill.

Pocket UPI makes life a lot easier when it comes to paying digitally. It’s fast, safe, helps you control your spending, and even gives you rewards. It’s definitely a smart way to handle your money.

How to Use Pocket UPI

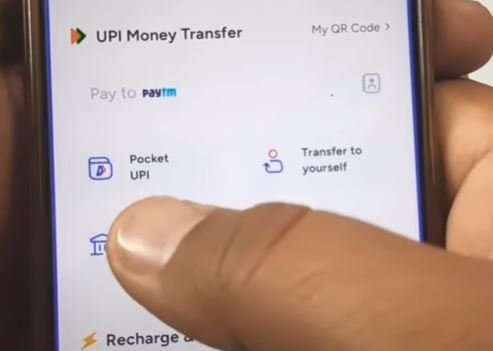

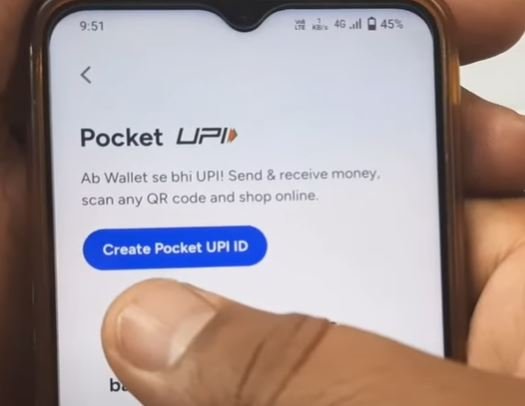

The first most important thing to make use of Pocket UPI is the Mobikwik app. Once you have installed the app and signed in, follow these steps to get started:

- Open up the App.

- Click on “Pocket UPI”

- Tap on Add Money (You need to Top up your wallet first)

- Choose the preferred payment method

Once you have the funds in the wallet, you can make use of the Pocket UPI to send money to any to any QR Code, any number, any UPI ID.

FAQs Related to Mobikwik’s Pocket UPI

How to Pocket UPI Different from UPI?

UPI uses bank accounts for payments and relies on the bank’s servers. On the other hand, Pocket UPI is a service by Mobikwik that lets users use UPI from their Wallet, which is Mobikwik’s Digital Wallet. There are no dependencies on Bank accounts in this case.

Is Pocket UPI Launched by NPCI?

No, it is not launched by the National Payment Corporation of India. It is a new feature by Mobikwik.

What are some of the benefits of Pocket UPI?

As banks are not involved, security is enhanced greatly. Also, non dependency on bank servers is additional benefit. Also you can easily track your expenses.

Quick Links

| Official Website | Click Here |

| Pocket UPI Details | Check Here |