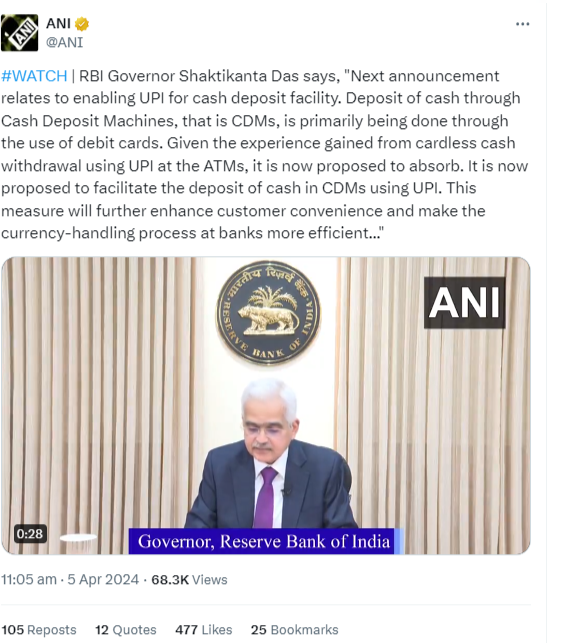

You can use UPI to deposit money at cash deposit machines and modern ATMs, instead of using your debit card. Currently, users are required to input their debit card into cash deposit machines, enter their PIN, and then deposit cash. However, with the announcement of Cash deposit using UPI (Unified Payment Interface) by RBI, this process will be simplified.

UPI Cash Deposit Feature Announced

In the past, customers could deposit cash by visiting the cashier counter at the bank’s physical location. Cash deposit machines, also known as CDMs, were later developed. Now, modern ATMs have the facility to deposit money integrated into them.

If you need to deposit money in bank account using CDM or ATM, the most important step is authorization. Before, authorization was done with a debit card, but now it can be done with UPI (Unified Payment Interface) integrated into apps.

UPI has revolutionized banking in India by making financial transactions faster, safer, and more convenient. One of its standout features is the ability to deposit cash directly into bank accounts. This article explains how to use UPI for cash deposits and provides a detailed guide for using this service.

How to Deposit Cash using UPI in ATM

The first step is to head to the nearest cash deposit machine (CDM) or Compatible ATMs. After that, follow these steps:

- Use “UPI Cash Deposit” instead of a debit card when depositing cash at a Cash Deposit Machine (CDM).

- Scan the QR code displayed on the CDM screen with your UPI app on your smartphone.

- Make sure that the deposit amount shown in the UPI app matches the amount of cash you want to deposit. Then, choose the bank account from your UPI-linked accounts to deposit the cash.

- Finally, authorize the transaction using your UPI PIN.

Where to Deposit Cash?

As specified earlier, to use the new Cash deposit using UPI feature, you need to visit :

- Nearest Cash Deposit Machine

- Nearest ATM with Cash Deposit Facility

In order to locate them, you can take help of Google Search and head to the nearest available source. Then you can follow the steps given above to complete the cash deposition using UPI.

As we will be doing this with the help of UPI, ensure that your smartphone is charged.

Benefits of Using UPI for Cash Deposits

The advantages of using UPI for cash deposits include:

Being able to deposit money anytime and anywhere without going to a bank branch is a major advantage of UPI. Another benefit is its speed, as transactions are completed instantly. Additionally, UPI charges minimal or no fees for transactions, making it a cost-effective option. UPI is accessible on smartphones, making digital payments easily available to many people.

Security Features and Tips for UPI Transactions

UPI is built with multiple layers of security:

- Two-Factor Authentication: UPI requires a mobile number and a UPI PIN to complete transactions, providing dual security.

- Encryption: End-to-end encryption ensures that your financial data is protected.

- Tips for Securing Transactions: Always keep your UPI PIN confidential, regularly update your app, and monitor your transaction history frequently.

Users sometimes face issues such as transaction failures or delays. Check your internet connection, make sure you entered the right payment information, and contact customer support if the problem continues.

As technology improves, UPI will add new features like linking several bank accounts to one UPI ID and integrating more financial services. The future of UPI promises more convenience and a better user experience for cash deposits.

Understanding UPI

The Unified Payments Interface (UPI) is a revolutionary payment system created by the National Payments Corporation of India. This advanced interface makes it easy to do real-time transactions between different banks using a user-friendly mobile app. It lets people manage multiple bank accounts and access various banking services.

UPI makes handling funds easier by offering a platform for seamless fund transfers and secure merchant payments. It also allows for easy “Peer to Peer” collection requests that can be scheduled for personal convenience. !

Setting Up UPI for Banking

To begin using UPI, you must first ensure that your mobile number is registered with your bank account. Follow these steps to set up UPI:

- Download a UPI-enabled app like BHIM, Google Pay, PhonePe, or your bank’s app from the App Store or Google Play.

- Set Up Your Profile: Enter details such as your name, virtual payment address (VPA), and password.

- Link Bank Account: Select your bank from the list provided in the app. The app will automatically fetch the bank account associated with your mobile number.

- Set UPI PIN: You will receive an OTP on your registered mobile number for verification. Use it to set your UPI PIN, which will be required for all transactions.

Challenges in UPI Cash Deposit Facility Implementation

As mentioned before, the Reserve Bank of India (RBI) has introduced a “first kind” feature that is now able to change the way one uses ATMs. The new UPI-enabled cash deposit feature will allow users to deposit cash directly into their bank accounts. The RBI is an ongoing commitment to modernize banking and enhance the convenience of digital transactions. The measure can be seen as promising, but at the same, it harbors a bunch of challenges and considerations that are not to be disdained.

Embracing New Possibly Accessibility Challenges -:Not all ATMs are instantly enabled for UPI-based cash deposit transactions. This time, the staggered rollout of this feature means that access could be uneven and, at times, it may leave the users in the lurch if this is something they might need to rely on for carrying out their day-to-day financial transactions.

Navigating the technical hurdles : However, with each new adopted technology, it does bring in its quota of bugs and glitches. Users are sometimes confronted with failures or delays in transactions—both are irritating and ruin plans. In this sense, the RBI and banks must fix these on a priority basis to build faith in the new system and reliability.

Security Risks: Digital transactions, convenient as they may be, often multiply one’s exposure to cyber threats. Users have to be careful with the risks of hacking and unauthorized access looming larger with such features. In this perspective, the efforts by the RBI to further strengthen security measures take quite important precedence in the safeguard of users’ finances.

Understanding costs and limits : The ease of use of UPI at ATMs, however, will not be without its own set of caveats. In this case, users might face limits in the transaction amount and, in some instances, also charges where they are otherwise not conducive to dealing with larger sums of money on a regular basis.

User Education : The Importance of Educating Users Great obstacles to the adoption of new banking technologies relate to public awareness and understanding. Full-scale educational campaigns are to be staged to provide users with ease and confidence in the effective use of those new services.

Dependence on Robust Connectivity : The entire success of digital transactions greatly banks on constant and reliable internet access. Where there is spotty connectivity, the chance of transaction failures stares at the users. This makes it, therefore, very important to ensure robust infrastructure for the smooth running of this feature.

Ensuring Compatibility : The incompatibility could also occur if some banks and ATMs are going for an upgrade to handle the new UPI feature. However, successful transactions without a glitch would require smooth communication between different banking systems and ATM networks.

The move by the RBI, in integrating UPI with ATM transactions, is nothing short of a forward-thinking global shift towards digital banking. It promises much more improved convenience and faster transactions. But, however, as we transit into this new banking epoch, both the user and the bank should be well-equipped to handle this and get prepared to avoid the likely challenges. Facing them squarely will give them the opportunity to maximize the potentials which digital banking offers.

Latest Updates

- RBI recently confirmed that customers can deposit cash at ATMs using UPI.

More UPI Updates HERE

UPI has significantly simplified the process of depositing cash into bank accounts. The new cash deposit using UPI facility is going to take over the traditional approach. This will ultimately benefit the UPI users.

List of Banks Currently working on this :

| State Bank of India | Bank of Baroda | City Union Bank |

| Union Bank of India | Indian Bank | Yes Bank |

| Canara Bank | Central Bank of India | Bank of India |

| Utkarsh Small Finance Bank | Punjab National Bank | Punjab and Sind Bank |

| UCO Bank | Indusind Bank | HSBC |

| Karur Vyasa Bank | Federal Bank | Ujjivan Small Finance Bank |

| Equitas Small Finance Bank | Suryoday Small Finance Bank | Fincare Small Finance Bank |

| Cosmos Bank | GP Parsik Sahakari Bank Ltd | Janata Sahakari Bank |

| The Mehsana Urban Co-op Bank | Andhra Pragathi Grameena Bank | Andhra Pradesh Gramin Vikas Bank |

| Chhattisgarh Gramin Bank | Deccan Gramin Bank | Uttarakhand Gramin Bank |

| Saurashtra Gramin Bank | Rajasthan Marudhara Gramin Bank | Karnataka Vikash Gramin Bank |

| Meghalaya Rural Bank | Arunachal Pradesh Rural Bank | Hitachi |

For Official details by National Payments Corporation of India, NPCI kindly Visit This Page.